Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

💰 The Monetization Verdict

Have you noticed how easy it has become to build an AI workflow? In 2026, chaining prompts and connecting APIs is no longer a moat. What’s rare — and incredibly valuable — is turning those workflows into products people actually pay for.

The uncomfortable truth? Monetization ideas are cheap; monetization workflows are not. The difference isn’t creativity; it’s operational design and trust. At Like2Byte, we’ve seen countless “AI side hustles” stall because they sell a helper, not a result.

A monetization idea is vague: “I’ll sell AI reports.” A monetization workflow is a business: it defines who owns the hallucination risk, how costs scale, and how the system recovers when an API goes down.

This is the fastest path to revenue. You sell a completed outcome (leads, edited videos, cleaned data). The client never sees the prompts; they only see the result. This shift is part of what Andreessen Horowitz calls ‘Taming the Tail’, where the value of AI monetization moves from raw access to specialized, reliable outcomes that justify the higher marginal costs of inference. This model is high-ticket but has a scalability ceiling unless you standardize inputs aggressively.

With workflow licensing, you don’t deliver the outcome — you sell the right to run a proven system. Instead of executing tasks for the client, you package your automation as an internal capability they can operate themselves.

Your role shifts from operator to architect. You provide the “brain” of the workflow — logic, prompts, guardrails, and documentation — while the client absorbs day-to-day execution risk. This dramatically improves margins, because usage variability no longer sits on your balance sheet.

This model works best in B2B environments where inputs are semi-structured and repeatable — internal reporting, lead qualification, data cleanup, content operations — and where you’ve already solved the messy input problem through constraints and validation.

Build the tech, let agencies own the distribution. Agencies want leverage; they want to offer AI results without hiring a prompt engineer. You provide the engine, they provide the brand. This is a volume play with high stability if you pick the right partners.

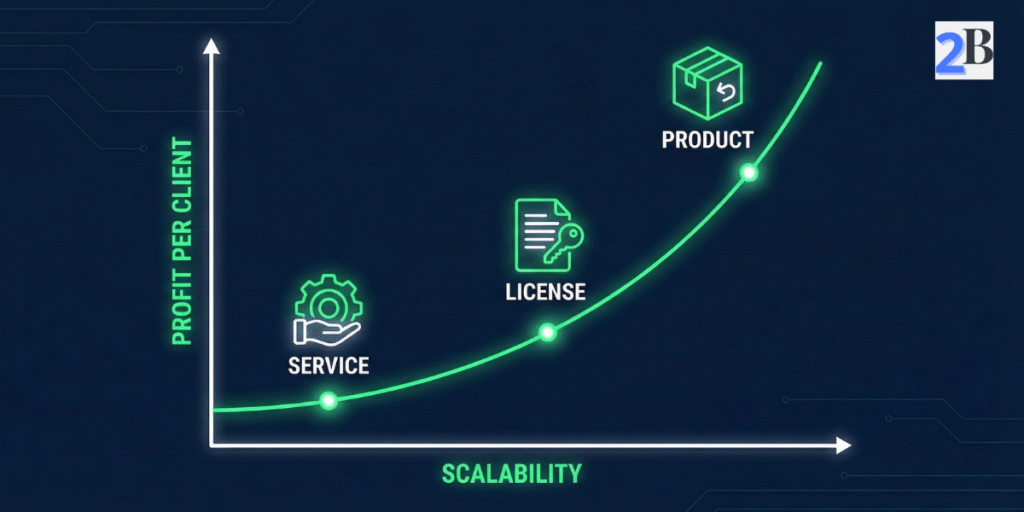

Comparison: How AI Revenue Scales

This model is often misunderstood — and frequently underpriced.

Customers don’t pay for prompts. They pay for structure. What sells here are complete systems: pre-defined workflows, guarded templates, internal toolkits, and repeatable execution logic that saves operators hours of trial and error.

The buyer is not a beginner. It’s an operator, founder, or team that already understands AI — and wants a shortcut to a working standard. Think onboarding systems, content pipelines, internal QA flows, enrichment logic, or reporting frameworks.

Margins are high, delivery cost is low, and distribution scales well. The trade-off is price: this model requires volume to match service-level revenue.

Most successful builders use this model after services or licensing — once the workflow has survived real-world abuse.

This is the hardest model — and the one most people try too early.

Productized AI looks like SaaS, but it behaves like infrastructure. Every interaction has a real cost, and power users can quietly destroy margins if usage is not governed.

Successful AI products do not sell “unlimited access.” They sell bounded capability: defined inputs, capped usage, clear outputs, and predictable failure modes. Credits, tiers, quotas, and degradation paths are not UX bugs — they are survival mechanisms.

This model only works when:

When done right, this becomes a durable business. When done early, it becomes a quiet margin leak disguised as growth.

To reach 2026-level profitability, you need to understand that every monetization model is actually a trade-off between Control and Leverage. Most builders fail because they choose a model that doesn’t match their current infrastructure capacity.

One of the most overlooked aspects of AI monetization is liability. In traditional software, if a button doesn’t work, it’s a bug. In AI, if the model “hallucinates” a legal fact or a medical advice, it’s a potential disaster. Establishing clear AI governance frameworks is now the industry standard for any builder looking to move from a hobbyist workflow to a professional, sellable product.

Your monetization model dictates who pays for that mistake:

Scaling an AI workflow isn’t just about getting more customers; it’s about surviving the operational drag. Each model has a “silent killer” that can turn a profitable month into a loss-making one.

💡 Where the Money Actually Leaks

These are not edge cases — they are common failure patterns once real usage starts.

Stop looking at fake Stripe screenshots. In the real world, AI workflows produce business money, which means pricing must anchor to ROI, not token costs.

Approximate pricing ranges observed across services, licensing, and productized AI workflows. Use as directional benchmarks (not guarantees).

| Model | Realistic Pricing (2026) | Primary Value Proposition |

|---|---|---|

| AI Services (Done-for-you) | $1,500 – $5,000 / month | Accountability, execution, and guaranteed delivery |

| Workflow Licensing | $500 – $3,000 upfront | Speed to implementation without ongoing dependency |

| White-Label Systems | $500 – $2,000 / month / partner | Resale margin, leverage, and agency scalability |

| Templates & Internal APIs | $49 – $299 per sale | Repeatability, structure, and execution speed |

Legend: Higher-ticket models trade scalability for accountability. Lower-ticket models scale better but require proven workflows and distribution.

At Like2Byte, we recommend a specific evolution path. Don’t build a product and hope people buy it. Follow this 3-step sequence to ensure your monetization workflow is grounded in reality:

Do the work manually assisted by AI. Charge high tickets. Your goal here isn’t scale; it’s Edge Case Discovery. You need to see all the weird ways your prompts break when they hit real-world data.

Take the guardrails you built in Phase 1 and package them. Sell this to other operators. You are still involved in support, but the client is pushing the “Run” button. This is where your margins start to skyrocket because you’ve decoupled your time from the compute.

This is the white-label or API stage. Your workflow is now so robust that it can handle messy inputs without human intervention. This is where true leverage happens. You are selling a “Black Box” that consistently turns inputs into outcomes.

Most builders should start with Services. It’s the only way to see where your AI breaks in the wild. Once you’ve fixed the same edge case for 10 clients, you have a Product. Scaling before this stage is the fastest way to bankrupt an AI business.

Related Guide: If you’re building in the voice space, see our AI Voice Agency Blueprint for a deep dive into outcome-based pricing.

In 2026, an Agency is often more profitable early on. It allows you to charge for “responsibility” while the AI is still maturing. SaaS requires infinite scalability and low support, which is hard to achieve with volatile LLM costs.

Prompts are commodities. Systems are assets. Don’t sell a prompt; sell a workflow system that include inputs, guardrails, and failure handling. That is what serious buyers invest in.

In the long run, Workflow Licensing and White-labeling offer the highest margins. While AI Services (Agencies) have high ticket prices, they also carry high labor costs for human-in-the-loop verification. Licensing decouples your time from the revenue, allowing you to maintain 80%+ margins once the initial system is built and stabilized.

The best defense is Contextual Value. If you only sell a simple prompt, a client can easily replicate it. If you sell a system—which includes proprietary data enrichment, multi-step verification, and integration with their existing tools—the cost for them to rebuild and maintain that “logic” themselves becomes higher than the cost of paying you.

The primary risk is Partner Dependency and Support Latency. When you white-label, you are one step removed from the end-user. If the AI hallucinates or the API goes down, the partner’s reputation is at stake, which puts immense pressure on you for 24/7 stability. You must have a robust Service Level Agreement (SLA) and clear failure-handling protocols in place.

For AI monetization, Usage-Aware Pricing (Credits) is safer and more transparent. Flat monthly fees expose you to “Token Arbitrage” by power users. A hybrid model—a base fee for access and a credit system for usage—is the standard for 2026, as it ensures that your revenue always scales alongside your infrastructure costs.

AI is no longer the differentiator — operational design is.

Workflows fail to monetize not because the models are weak, but because ownership is unclear. If no one clearly owns failure, retries, quality control, and cost overruns, the workflow isn’t a product yet — it’s an experiment.

The shift that unlocks monetization is simple but uncomfortable: stop selling access to AI and start selling accountable outcomes. When responsibility is explicit, pricing becomes rational, margins stabilize, and growth stops breaking the system.